Resilient, Surprising, but Sustainable? U.S. Growth Under the Lens

- Girish Appadu

- Sep 29, 2025

- 2 min read

The U.S. economy continues to surprise. Recent data show growth holding strong, driven by resilient consumers and solid spending.

Q2 GDP was revised higher to 3.8% annualized, well above the long-term trend of 1.5%–2.0%.

Consumer spending, the engine of U.S. growth, surged 2.5% versus forecasts of 1.7%.

August data reinforced the trend, with personal income and real spending both beating expectations.

Looking ahead, the Atlanta Fed’s GDPNow model points to third-quarter growth of 3.9%, suggesting the economy is running above trend. The Bloomberg Economic Surprise Index also shows a clear uptick, highlighting consistent upside surprises.

Key Watchpoints

Two variables will determine if this momentum is sustainable:

Labor Market: Jobless claims have eased again after a temporary spike, signalling stability. The October jobs report will be closely watched.

Inflation: The Fed’s preferred gauge, PCE inflation, remains sticky at 2.7% headline and 2.9% core. Goods inflation may rise due to tariffs, while services inflation shows signs of cooling.

The Fed will weigh these signals carefully ahead of its October 29 policy decision.

Near-Term Risks

Even with strong fundamentals, investors should monitor:

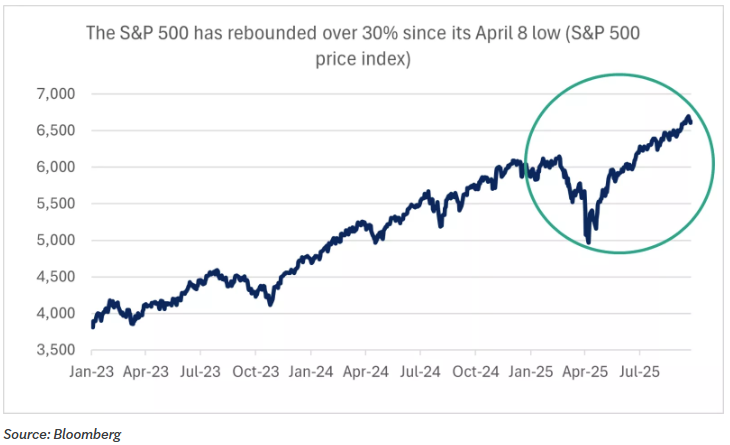

Markets running hot. Since April, the S&P 500 has rallied over 30% without a pullback. Seasonal October volatility and profit-taking could trigger a typical 5–10% correction.

U.S. government shutdown headlines. If Congress fails to pass funding measures, a short-term shutdown could create noise, dampen sentiment, and spark volatility.

Portfolio Positioning

Resilience doesn’t mean complacency. We recommend:

Diversification.

Quality bonds.

Cash review. Excess cash tends to underperform; market pullbacks may offer opportunities to redeploy.

Bottom Line

The U.S. economy is holding firm, with consumers leading the charge. Short-term risks, market volatility or a government shutdown, are unlikely to derail the broader expansion. Long-term investors should stay diversified, disciplined, and ready to act on opportunities.

Comments