Quarterly Market Update

Market Review as at 31 October 2025

The third quarter of 2025, along with October, proved broadly positive for global markets, as equities delivered solid gains while government bonds edged slightly into positive territory. Early geopolitical tensions gave way to renewed optimism following late-stage negotiations between the United States and China, which culminated in a one-year trade truce. This agreement paused tariff escalations and eased restrictions on rare earth minerals which are critical to the AI supply chain. This provided a significant boost to global sentiment. At the same time, moderating inflation data suggested that tariff-related passthrough has, so far, been more modest than many feared, further supporting risk appetite.

Global equities rallied strongly, driven by continued enthusiasm around artificial intelligence, resilient corporate earnings and a pivotal interest rate cut by the U.S. Federal Reserve. The MSCI World Index advanced by 7.74% during the quarter. In the United States, equity markets surged to near all-time highs, with the S&P 500 and Nasdaq Composite Index setting new records. Growth sectors dominated, particularly technology and communication services, which benefited from the ongoing AI boom. Conversely, healthcare and energy lagged, with the latter weighed down by declining oil prices. While this renewed optimism is encouraging, it also suggests that much of the good news is already priced in, leaving little margin for error should conditions shift.

European markets also posted gains, supported by improved risk appetite and the European Central Bank’s accommodative stance. However, performance was more muted compared to the U.S., reflecting lower exposure to technology and political uncertainty in France. Financials were among the key drivers in the region. In Asia, Japanese equities stood out as top performers, with the Nikkei 225 Index rising nearly 11.0% in the quarter. A weaker yen, a favourable U.S.-Japan trade agreement reducing tariffs and ongoing corporate governance reforms all contributed to this strength. The appointment of Sanae Takaichi as Japan’s first female prime minister added to market optimism, as her commitment to expansionary fiscal and monetary policies was viewed positively by investors.

China’s technology sector experienced a sharp rally, with the Shanghai Composite Index climbing 12.73% for the third quarter and 18.0% year-to-date. Policy support for domestic chipmakers and accelerated AI investment drove this surge, while easing trade tensions and hopes for structural economic reforms provided additional tailwinds. In contrast, India continued to underperform relative to peers, as foreign investors sought higher yields elsewhere. The market remained largely supported by domestic investors, though long-term growth drivers remain intact.

On the fixed income front, performance was broadly flat, with the Bloomberg Aggregate Bond Index posting a slight gain for Q3. Major central banks either maintained policy rates or adopted an easing bias. Signs of a softening labour market and contained inflation reinforced expectations for further monetary support. The Federal Reserve delivered a 25-basis-point rate cut at its latest meeting, while the ECB held rates steady, signalling confidence in the current inflation trajectory.

Commodities posted modest gains overall, led by a significant rally in precious metals. Gold and silver reached record highs as investors sought safe-haven assets amid lingering uncertainties. However, the energy sector remained under pressure, with oil prices declining on concerns of oversupply, a trend expected to persist into 2026.

In currency markets, the U.S. dollar weakened for much of the year, driven by fiscal uncertainty and capital flows into alternative assets such as gold, the Swiss franc, and the Japanese yen. Emerging market bonds also attracted inflows. However, the dollar stabilized and staged a recovery in the third quarter, with the DXY Index rallying into October.

Source: Morningstar, Investing.com & Mauritius Commercial Bank Ltd

Macroeconomic Outlook

Macroeconomic projections are looking subdued.

GDP Growth:

GDP growth is expected to slow in 2026 compared to 2025 across the major regions, except for US driven by steady consumer spending and easing monetary policy.

For 2027, GDP is expected to grow at a slightly faster pace than in 2026 across the major economies (on the back of recovery from tight financial conditions and structural adjustments in the Eurozone), the exceptions being the US, China (reflecting structural reforms and weaker external demand) and Japan (reflecting stagflation).

Real GDP growth forecasts (% change, yoy)

Source: IMF

Annual real GDP growth rates from 1980 to 2030 for the major economies

China consistently outpaced other regions with double-digit growth in the 1980s and 1990s, gradually slowing after 2010 but remaining above global averages. The US, EA, UK, and Japan exhibit relatively stable growth around 2–4%, with Japan trending lower over time. Global growth fluctuates moderately, with sharp downturns during major crises, most notably in 2009 and 2020, where all regions experienced steep contractions, followed by strong rebounds. Projections from 2025 onward suggest modest, steady growth for all regions, with China still leading but at a reduced pace.

Inflation Expectations:

Inflation for the 2nd half of 2025 is expected to rise in the US (due to strong demand and wage pressures in the near term) and in China but is expected to moderate in the Eurozone (reflecting weaker growth and energy price normalization) and in Japan.

For 1H 2026, inflation is expected to moderate across all major regions with the exception of UK which remains elevated due to persistent structural inflation drivers such as labour shortages and elevated service costs.

Inflation Expectations (%)

Source: Trading Economics

Core inflation trends across major economies (US, EA, UK, China, and Japan) from 2021 to 2025.

Inflation surged globally in 2022, with the UK peaking above 7%, followed by the EA and US at around 6%, while China and Japan remained much lower.

After mid-2023, inflation rates declined sharply in the US and EA, stabilizing near 2–3%, whereas the UK maintained relatively higher inflation around 4–5%.

China and Japan exhibited the most stable and lowest rates throughout the period, hovering near or below 2%. By 2025, all regions show moderate inflation, but the UK continues to lead with persistently higher rates.

Interest Rate Expectations:

Interest rates are expected to fall across the major economies, except Japan and the Eurozone (flat) in both the 2nd half of 2025 and the 1st half of 2026 to support slower growth amid moderating inflation.

Overall, the outlook suggests moderate rate cuts in the US, UK, and China, stability in the Eurozone, and gradual tightening in Japan.

Interest Rate Expectations (%)

Source: Trading Economics

Interest rate trends for major economies (US, EA, UK, China, and Japan) from 2021 to 2025.

Rates remained near historic lows through 2021, then surged sharply from 2022 to mid-2023 as central banks tightened policy to combat inflation, with the US and UK leading hikes above 5%, followed by the Euro Area around 4%.

China maintained relatively stable rates near 2.5%, while Japan stayed close to zero with only slight increases.

By 2024–2025, rates began to ease slightly in the US, UK, and EA but remained elevated compared to pre-2022 levels, signalling a prolonged period of tighter monetary conditions.

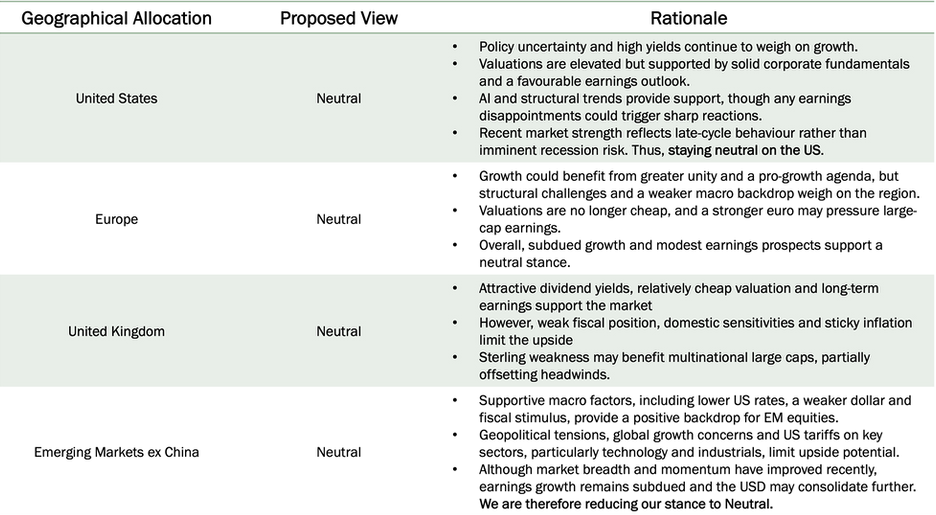

Asset Allocation

Equities