Power Is Becoming the New Capital

- Girish Appadu

- Jan 20

- 3 min read

Artificial intelligence adoption is driving the largest data centre expansion in modern history. As capacity accelerates, electricity rather than land, capital or chips is becoming the defining constraint. The winners in artificial intelligence will be those who secure reliable and affordable power at scale.

A Global Expansion at Unprecedented Scale

Artificial intelligence has pushed data centres into a new era of rapid growth:

More than 10,500 data centres across 174 countries.

Global demand expected to almost triple by 2030.

Approximately USD 7 trillion forecast for construction and upgrades by 2030.

Power usage set to reach 219 gigawatts within five years, enough to supply around 180 million United States homes.

Hyperscale facilities now reaching up to 10 million square feet.

The United States hosts nearly 40 per cent of global capacity.

Although not all facilities are dedicated to artificial intelligence, artificial intelligence workloads are expected to represent between 50 and 70 per cent of all computing by 2030, making artificial intelligence the principal driver of infrastructure growth.

Europe and the Frankfurt Constraint

Europe’s data centre footprint is heavily concentrated and Germany plays an outsized role:

Fifteen per cent of European data centres are located in Germany.

Frankfurt hosts nearly one quarter of those data centres.

All future energy capacity in Frankfurt has already been allocated.

DE CIX, the largest internet exchange in the world, helped make Frankfurt a key location, but power availability is now the limiting factor

Frankfurt illustrates a global reality. Connectivity attracts data centres, but electricity determines how many can actually be built.

Economic Impact: Growth Meets Restriction

Data centre development is generating extensive economic activity:

United States regions with significant data centre clusters generate more than

USD 30 billion in additional annual economic output.

Global data centre revenue expected to reach USD 624 billion by 2029.

Hyperscale operators projected to spend USD 525 billion in capital expenditure by 2032.

Yet electricity has become the central constraint:

Data centre electricity demand rising at approximately 16 per cent annually.

By 2028, data centres may consume up to 12 per cent of all United States electricity.

Electricity prices in major data centre hubs have increased by up to 267 per cent in five years.

Grid upgrades expected to require USD 720 billion by 2030.

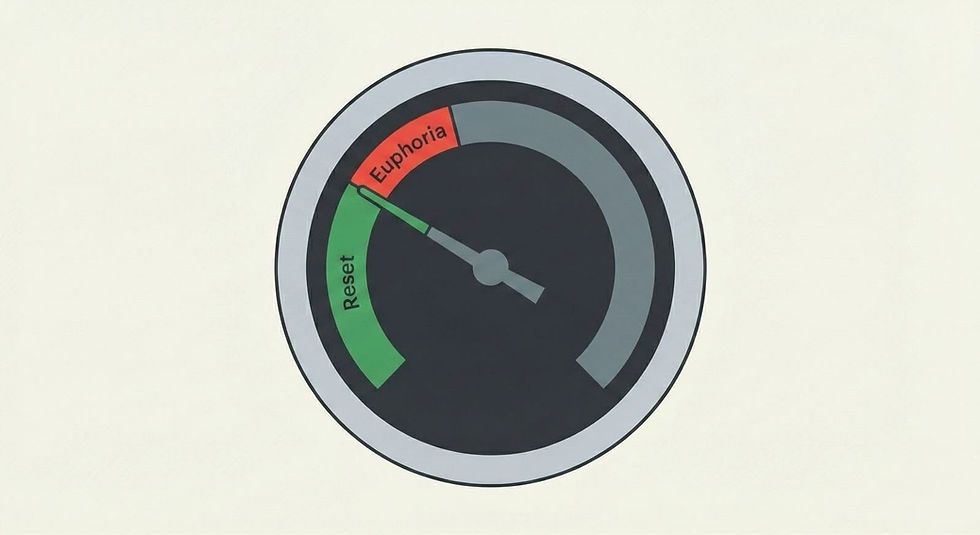

Electricity has become the new cost of capital.

Power: The New Strategic Restriction

It currently takes around eight years to build the necessary infrastructure to supply new data centres without placing strain on the existing grid. More than seventy per cent of industry leaders now describe power availability as very challenging or extremely challenging.

As a result:

New projects are being delayed or reduced in scale.

Behind the meter power generation is gaining momentum.

Up to 25 gigawatts of onsite power expected within five years.

Natural gas dominates for now, but fuel cells and small modular reactors are emerging as alternatives.

The Uncomfortable Comparison: U.S. vs China

United States electricity prices now average approximately USD 0.19 per kilowatt hour, which is almost four times higher than in the early 1980s. The most concerning rise has occurred since 2020.

China maintains significantly lower electricity costs through:

Large scale

A strong mixture of coal, hydroelectric and nuclear power

State regulated pricing

Cheaper power translates into cheaper computing, cheaper storage and cheaper manufacturing.

The long-term risk for the United States is not widespread blackouts. It is sustained cost inflation embedded in critical growth sectors.

Policy, Public Pressure and Momentum

Technology giants are moving ahead at extraordinary speed:

Meta invested USD 17 billion US dollars in capital expenditure in one quarter.

Microsoft invested USD 24.2 billion in the same period.

Amazon is investing more than USD 26 billion across several United States campuses.

However, households are facing rising energy bills. Federal and state officials are pressuring grid operators such as PJM to contain price increases, including calls for emergency power auctions funded by major data centre users.

Despite uncertainty in policy, the United States entered 2026 with stronger energy production momentum than at any time in recent decades. This is essential for sustaining artificial intelligence driven growth.

Investment Takeaway

The data centre boom sits at the intersection of AI, infrastructure, energy and geopolitics. While growth prospects are immense, power availability and pricing are now the critical constraints shaping returns, capital allocation and global competitiveness.

For investors, the opportunity is not only in technology but across energy, utilities, grid infrastructure, and alternative power solutions.

Electricity is no longer just an input. It is strategy.

Comments