Is Complacency Taking Hold in the Market?

- Girish Appadu

- Oct 14, 2025

- 2 min read

President Trump’s announcement of a 100 percent tariff on Chinese imports and new export controls on critical software has reignited trade war concerns. Markets reacted sharply with USD 2.5 trillion in equity losses and USD 19.5 billion in crypto liquidations in a single day. They stabilized quickly, showing both sensitivity and resilience.

Markets in 2025 have become highly reactionary. Liquidity, leverage, and algorithmic trading amplify short-term swings and often make emotions a stronger driver than fundamentals. Discipline and objectivity remain the most important sources of alpha.

The US government shutdown has entered its second week. Over 650,000 federal employees have already missed pay, and this number could rise above three million if the closure continues.

Investor attention has shifted to artificial intelligence, with large-scale investments such as AMD supplying AI chips to OpenAI driving capital into large-cap technology names.

Gold has been one of 2025’s standout assets. It has risen over 50 percent since the start of the year and surpassed USD 4,000 per ounce. Fiscal sustainability, central bank independence, and long-term value preservation appear to be key drivers. Investors should approach the rally with caution.

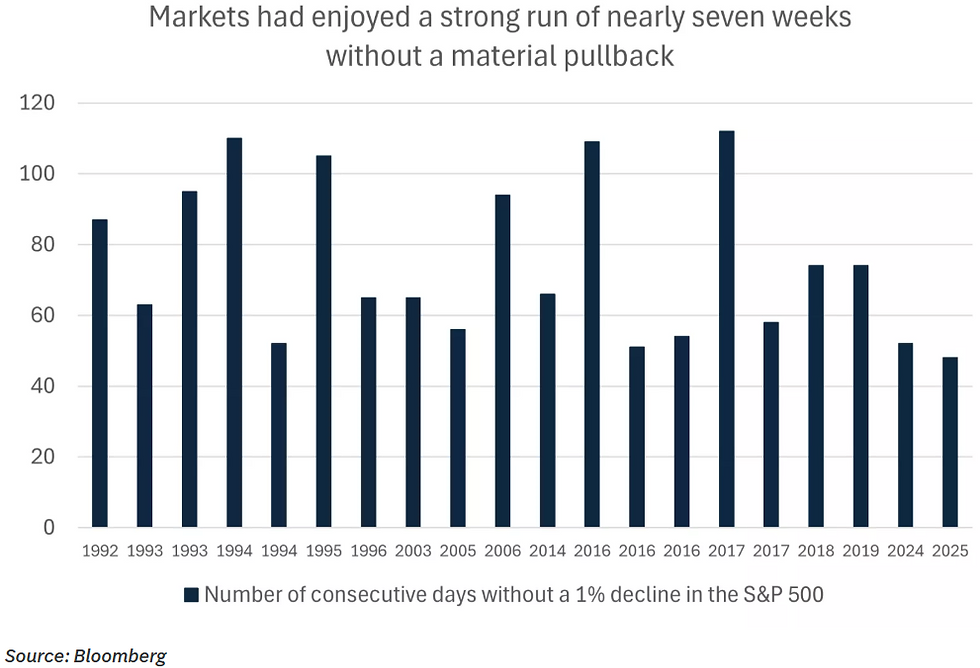

October historically brings higher volatility. Current conditions, including elevated valuations, policy uncertainty, and geopolitical risk, suggest that short-term market adjustments are possible. Pullbacks may provide opportunities to rebalance portfolios, capture attractive entry points, and diversify exposure.

Key Takeaways

Markets are fast and reactionary, and emotions often outweigh fundamentals

Trade tensions and the government shutdown remain important uncertainties

AI-focused equities and gold offer opportunities, but caution and discipline are essential

At Intrasia Wealth, we remain constructive on the medium-term outlook. Expected rate cuts, potential fiscal easing, and stabilizing trade dynamics should support economic growth and corporate earnings in 2026. Composure, patience, and a disciplined approach remain the most effective strategies for navigating today’s fast-moving markets.

Comments