Are Bond Yields Warning of a Global Fiscal Storm?

- Girish Appadu

- Sep 2, 2025

- 2 min read

Updated: Sep 3, 2025

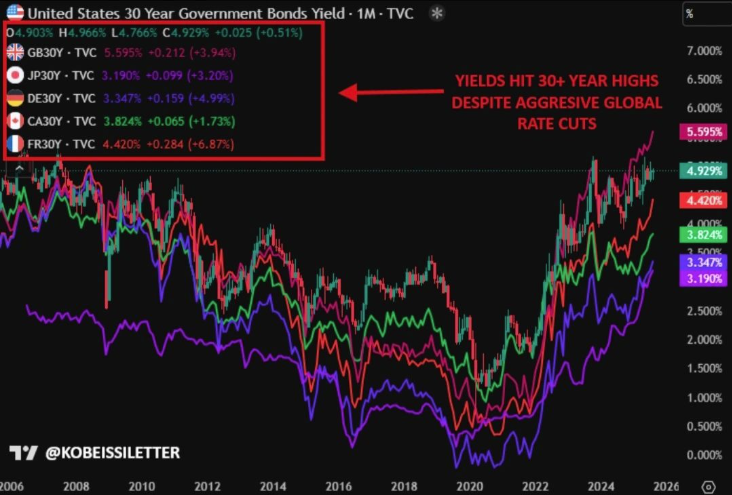

74% of the world’s central banks cut rates in 2024, the highest since 2021. In May 2025 alone, central banks cut rates 15 times. And yet, instead of falling, bond yields have surged to their highest levels in over 30 years.

Why?

Because deficit spending is spiralling out of control and inflation is back on the rise.

Put simply: we now face higher interest rates despite rate cuts. And when bond markets speak, investors should listen.

Nowhere is this clearer than in the UK, where a silent fiscal collapse is underway.

Debt has exploded to £2.7 trillion (96% of GDP).

Interest payments are heading for £111 billion, £1 in every £12 the government spends.

Yields are higher than in the US and even Greece.

The UK’s 30Y gilt yield just hit 5.64%,a level last seen in 1998. That’s 15x higher than the 2020 lows. Meanwhile, the BOE is slashing rates to 4%, even though inflation is at 3.8% and climbing past 4%.

This is the definition of being boxed in: growth is stalling, bankruptcies are back at 2008 levels, and stagflation risks are flashing red.

And the outlook is brutal. Spending is set to exceed 60% of GDP, revenues are sliding under 40%, and by 2073 debt could reach 274% of GDP. Interest alone would eat around 13% of output. Wartime deficits… with no war. These are fiscal gaps not seen since the Napoleonic era.

But this isn’t just Britain’s problem.

Japan’s 30Y yield broke above 3.20% for the first time in history.

US 30Y yields are closing in on 5.00%.

Gold is up +30% YTD, tripling the S&P 500’s return even in a bull market.

That’s not “normal” price action. That’s the bond market screaming: deficit spending has consequences.

At Intrasia Wealth, we believe investors need to prepare for a world where fiscal imbalances, inflation risks, and rate volatility define market dynamics. Diversification, active risk management, and real assets are no longer optional. They are essential.

The UK may be the canary in the coal mine.

Others, especially the US, are not far behind.

Comments